Grassroots

Memo on New Landlord Tenant Laws

| Memo on New Landlord Tenant Laws |

Contact the US Senate Today to Prevent an Eviction Moratorium Extension

| August 2020 Affiliates Letter to Senate.docx |

| senate_housing_staffers.xlsx |

Know Your Home Value Campaign Launches Ahead of Triennial Update

July 22, 2020

FOR IMMEDIATE RELEASE

COLUMBUS, Ohio – Franklin County Auditor Michael Stinziano announced Monday the launch of the Know Your Home Value campaign to educate property owners about the role they have in determining their assessed property value.

The Know Your Home Value initiative comes as the Auditor’s office launches the Triennial Update, which will update property values for all 435,000-plus parcels in Franklin County.

In Ohio, county auditors are required to do a full, general reappraisal once every six years. On the third year in between reappraisals, county auditors are required by Ohio law to adjust property values based on sales and the market over the past three years. The Franklin County Auditor's office last performed a full property appraisal in 2017, so state law requires a Triennial Update in 2020.

“I want property owners to know they have a role and a voice in determining their property values,” Stinziano said. “There will be many opportunities for owners to be involved, and I hope the Know Your Home Value campaign will educate everyone on how they can participate in the Triennial Update process.”

The Auditor’s office has launched a new website, your2020homevalue.org, with Triennial information, an educational video and the ability to schedule virtual and in-person Informal Value Review meetings where homeowners can challenge their tentative home values. Because of the pandemic, the office has adapted and is encouraging the use of virtual meetings, where owners can discuss their property values online with an appraiser from the comfort of their homes.

As part of Know Your Home Value, the Auditor’s office convened a community focus group to get feedback on the Triennial Update plan. The office is also partnering with the Kirwan Institute to look towards the appraisal process with an equity-focused lens throughout the update process.

Here is how the Triennial Update works:

July 22, 2020

FOR IMMEDIATE RELEASE

COLUMBUS, Ohio – Franklin County Auditor Michael Stinziano announced Monday the launch of the Know Your Home Value campaign to educate property owners about the role they have in determining their assessed property value.

The Know Your Home Value initiative comes as the Auditor’s office launches the Triennial Update, which will update property values for all 435,000-plus parcels in Franklin County.

In Ohio, county auditors are required to do a full, general reappraisal once every six years. On the third year in between reappraisals, county auditors are required by Ohio law to adjust property values based on sales and the market over the past three years. The Franklin County Auditor's office last performed a full property appraisal in 2017, so state law requires a Triennial Update in 2020.

“I want property owners to know they have a role and a voice in determining their property values,” Stinziano said. “There will be many opportunities for owners to be involved, and I hope the Know Your Home Value campaign will educate everyone on how they can participate in the Triennial Update process.”

The Auditor’s office has launched a new website, your2020homevalue.org, with Triennial information, an educational video and the ability to schedule virtual and in-person Informal Value Review meetings where homeowners can challenge their tentative home values. Because of the pandemic, the office has adapted and is encouraging the use of virtual meetings, where owners can discuss their property values online with an appraiser from the comfort of their homes.

As part of Know Your Home Value, the Auditor’s office convened a community focus group to get feedback on the Triennial Update plan. The office is also partnering with the Kirwan Institute to look towards the appraisal process with an equity-focused lens throughout the update process.

Here is how the Triennial Update works:

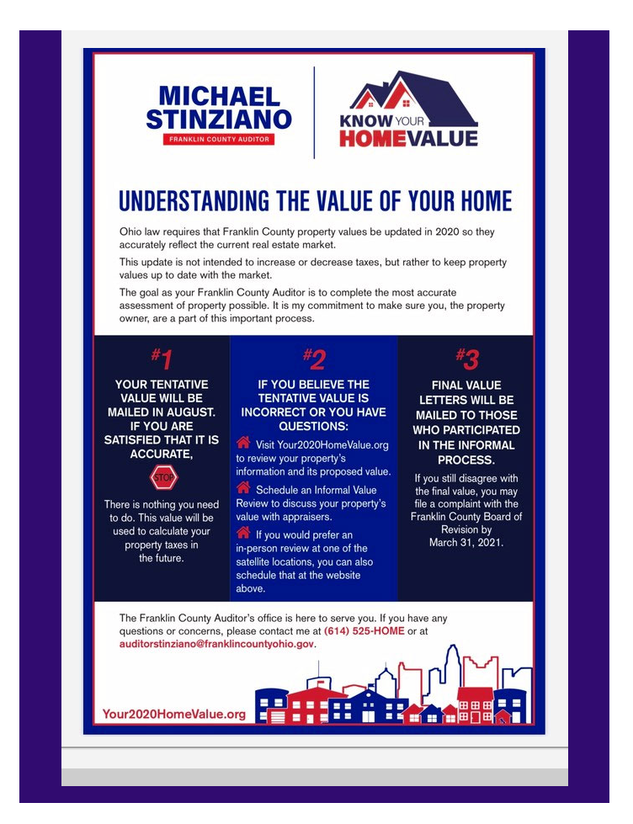

- Tentative property values will be mailed to every Franklin County property owner in late August. If they agree with the value, there is nothing more they need to do.

- If the property owner disagrees with the proposed value, they may participate in an Informal Value Review and discuss their property value with an appraiser.

- Final values for people who participated in informal reviews will be mailed out in December. If an owner still disagrees, they may file a complaint with the Franklin County Board of Revision, which hears challenges to property values.

| Understanding The Value Of Your Home.pdf |

Rent Cancellations? Congress needs to pass rental assistance!

When rents aren't paid, there is a cascade of effects across the country: unpaid mortgages, unpaid utility bills, lower property taxes. Tell Congress to pass rental assistance!

For more information, click here

When rents aren't paid, there is a cascade of effects across the country: unpaid mortgages, unpaid utility bills, lower property taxes. Tell Congress to pass rental assistance!

For more information, click here

On January 11, 2013, CAA staff met with Gary Smith, Appraisal Director for the Franklin County Auditor. The discussion focused on how the auditor might be able to prevent some properties from requiring a Board of Revision appeal. The primary focus was on properties that are income restricted. In the past, these properties have been appraised as fee simple and unencumbered, meaning that restrictions placed on rents were not considered, resulting in higher valuation that is supported by the property economics. To have the valuation reduced required a Board of Revision appeal. Owners of these properties that had successful appeals often saw huge valuations increases at the next valuation update. The problem lies in the fact that the appraiser did not know these properties were income restricted and revalued them as market rate. CAA suggested that the auditor devise a method to code all of these properties as encumbered to prevent improper valuations in the future. The auditor’s office was agreeable to explore a system to annotate the auditor files to reflect properties that are income restricted. CAA also offered to provide a list of all restricted properties in Franklin County.

We also had a discussion about operating costs for various types of multifamily properties and the CAA will work with the auditor to explain why certain types of properties will have operating costs higher than others.

The last item we discussed was how to create a process that would allow a property owner who was building a new property or rehabilitating an existing property to have an informal review of the valuation prior to the tax valuation being certified by the state of Ohio. The state of Ohio certifies valuation on October 30th each year. After the valuation is certified, the county auditor cannot change the valuation. Valuation change requires an appeal to the Board of Revision. In the past, the auditor’s office would not have an informal discussion during the construction rehabilitation phase. If the property was brought online close to the October deadline, the owner would not know that the property valuation was too high and be required to do a Board of Revision appeal. The auditor office is now willing to meet during the construction/rehab phase to have an informal discussion about value.

To arrange for an informal review contact:

Gary Smith

Appraisal Director

Franklin County Auditor

[email protected]

614-525-6250

We also had a discussion about operating costs for various types of multifamily properties and the CAA will work with the auditor to explain why certain types of properties will have operating costs higher than others.

The last item we discussed was how to create a process that would allow a property owner who was building a new property or rehabilitating an existing property to have an informal review of the valuation prior to the tax valuation being certified by the state of Ohio. The state of Ohio certifies valuation on October 30th each year. After the valuation is certified, the county auditor cannot change the valuation. Valuation change requires an appeal to the Board of Revision. In the past, the auditor’s office would not have an informal discussion during the construction rehabilitation phase. If the property was brought online close to the October deadline, the owner would not know that the property valuation was too high and be required to do a Board of Revision appeal. The auditor office is now willing to meet during the construction/rehab phase to have an informal discussion about value.

To arrange for an informal review contact:

Gary Smith

Appraisal Director

Franklin County Auditor

[email protected]

614-525-6250